Identify the Signs of Unmanageable Debt: Essential Indicators to Consider

Debt consolidation loans can serve as an essential financial resource for alleviating overwhelming economic pressures. However, it is crucial to recognize when these options should be explored. Seek out debt consolidation only when your existing financial commitments have escalated to a point that feels unmanageable. Recognizing the symptoms of unmanageable debt is the vital first step in taking control of your financial trajectory and restoring stability to your financial future.

When used judiciously, debt can be a strategic tool to foster your personal wealth and help you achieve your financial objectives. Conversely, if left unchecked, it can lead to profound financial turmoil, creating a scenario in which recovery seems unattainable. Understanding the juncture at which debt becomes a burden is fundamental for safeguarding your financial health and ensuring long-term well-being.

Evaluate Your Financial Landscape: Determining Your Debt Threshold

It is important to understand that the total amount of debt you carry is not the only concern; rather, the emphasis should be placed on your monthly repayment obligations. If your monthly payments are manageable and easily fit within your budget, this is an encouraging sign of financial stability. However, if meeting these payments feels like an ongoing struggle, you may be nearing a financial crisis that requires immediate attention and action.

This is where debt consolidation loans can play a transformative role in relieving your financial burdens by lowering your overall monthly payment commitments. By turning what may appear to be overwhelming debt into a more manageable situation, you can work towards restoring your financial equilibrium and peace of mind, allowing you to focus on achieving your long-term goals.

A key measure for assessing your ability to handle debt is the ratio of your monthly debt repayments to your gross monthly income, which is the total income you earn before taxes and other deductions. This essential metric, known as the debt-to-income ratio, acts as a crucial gauge of your financial health and overall stability.

While there isn’t a hard and fast rule for an acceptable debt-to-income ratio, dedicating more than one-third (or 33%) of your gross monthly income to recurring debt payments can indicate potential financial challenges ahead. This is particularly significant if you do not have a mortgage, as lenders may be reluctant to approve mortgage applications when your debt-to-income ratio exceeds the low 40% range.

It’s important to remember that a mortgage is a type of debt, and including it in your calculations can further elevate your debt-to-income ratio. In some cases, financial advisors may even suggest that a debt-to-income ratio nearing 50% might still be manageable, depending on personal circumstances and financial strategies.

In general, a debt-to-income ratio ranging from approximately 35% to 49% often acts as a cautionary signal of possible financial difficulties on the horizon. However, it is vital to keep in mind that these benchmarks are not universally applicable. The nature of the debt you carry plays a significant role in determining what is manageable for you. For instance, secured loans, such as mortgages, are usually viewed more favorably than unsecured debts like high credit card balances, which can pose serious threats to your financial health.

Explore Essential Resources for Mastering Effective Debt Management

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

In-Depth Analysis of Debt Consolidation Loans in the UK: Advantages and Disadvantages

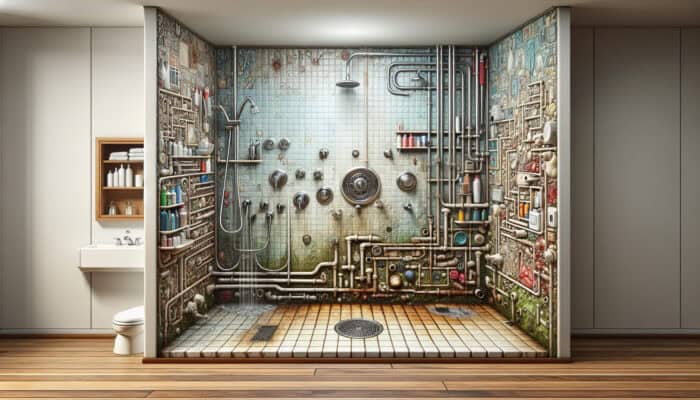

Debt Consolidation Loan Options for Home Improvements

Debt Consolidation Loan Options for Home Improvements

Enhance Your Property Value with a Debt Consolidation Loan for Home Renovations

Debt Consolidation Loan: Is It Suitable for You?

Debt Consolidation Loan: Is It Suitable for You?

Is a Debt Consolidation Loan the Right Choice for Your Financial Needs?

Furlough Rights Explained: Know Your Entitlements

Furlough Rights Explained: Know Your Entitlements

Navigating Your Furlough Rights During Economic Uncertainty

Couple Up to Cut Back on Tax: Smart Saving Strategies

Couple Up to Cut Back on Tax: Smart Saving Strategies